Moving Day: Checklists & Tips to Stress Less

Ah, moving day…that magical mix of excitement, chaos, and occasional panic. Whether it is across town or cross-country, the reality of packing, moving, and setting up a new home can become overwhelming. No list can make a move “stress free,” BUT planning ahead and staying organized can help make your move a little smoother. Here is a printable checklist along with our tips for the big day:

Getting Started

Once you know your prospective move date, set up a quick timeline to make sure you can get all the important tasks done and ready in time for your move.

Consider how much stuff you have by doing a home inventory. This can help you decide whether you need to hire movers to help you or if you will be managing your move on your own. Many moving companies supply inventory lists to help you assess the size of truck you will need. You can use your list as double duty for insurance purposes later (try using this helpful home inventory app from the National Association of Insurance Commissioners).

As soon as you decide how you will be moving, make your reservations. In general, moving companies and truck rental services are over-booked at the beginning and very end of the month. If you are planning on hiring a moving company, contact a few in your area for a price quote. To find companies ask your real estate agent, family, or friends, and consult online reviews. It is also a good idea to request a quote and compare companies.

Preparing for Your Move

- Moving is a great opportunity to get rid of clutter, junk, or outdated items. Set aside some time to sort through your closets, storage spaces, files, drawers, and more. Go through cluttered areas and organize items by “keepers”, “give-aways” and “garbage”. You will have less to pack and an opportunity to update after you move. Contact a local nonprofit organization for your donations; some will arrange to pick up larger donations like furniture. If you have items of value, eBay or craigslist are good options.

- Changing your address is one of the more tedious tasks in the moving process. You will need to change your address with the United States Post Office. You can find the online form here: Movers Guide.

You will also need to change your address with each account you have. Here is a list to get your started:

- Employers

- Bank(s)

- Utilities (Electric, Water/Sewage, Oil/Gas)

- Cable/ Telephone

- Cell phone service

- Credit Cards

- Magazine subscriptions

- Insurance companies (auto, home/renters, health, dental, vision, etc.)

- Pharmacy

- Other personal services

Let the Packing Begin

Before you start packing, it may help to visualize where everything you have will go. Perhaps furniture will fit better in a different room? Consider the floor plan of your new home and figure out what will go where. This will aid in packing and labeling as you box everything up.

Use a tool like floorplanner.com to plan where furniture and items will go.

When it comes to packing you have some options. You can work with a service that provides reusable boxes for moving or you can reuse or purchase cardboard boxes. Make sure you have enough boxes, packing tape, dark markers, and packing paper.

Pack rooms according to your floor plan. Label boxes with contents and room. This will make it easier to unpack your home, knowing where everything is going.

Real Simple magazine has some great tips on packing for your move.

If you have to disassemble any of your furniture, make sure you keep all the parts and directions together. Make sure you set aside your necessities for the day you move. Being tired and unable to take a shower or make your bed can be hard at the end of a long moving day. Here are some ideas of what you may like to pack in your “day-of-move” boxes:

- Clean linens for the beds, pillows and blankets

- Clean towels

- Shower curtain, liner and hooks

- Toiletries, hand soap, tooth brush, etc.

- Disposable utensils, cups, napkins, etc.

- Rolls of toilet paper

- Snacks and water

- Change of clothes

- Tools for reassembling furniture, installing hardware, and hanging photos

Making Your Move

- Come up with a game plan with your family, so everyone has a role and a part to play

- Once the house is empty, do a once over on your old place to make sure it is clean for the next owners/occupants. Here is a useful checklist for cleaning.

Warming Your New Home

Once you have settled into your new home, warm it up by inviting friends and family over to celebrate. Here is a great infographic about housewarming traditions and symbolism. Announce your move to far-away friends and family through moving announcements to make sure you stay on the holiday card mailing list.

Ready to make your move? Reach out to get started.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Remodeling Projects to Avoid When Selling Your Home

It’s common for homeowners to feel compelled to remodel their homes before they sell. Renovating the spaces in your home can increase its value and help you compete with comparable listings in your area. However, some remodeling projects are more beneficial than others as you get ready to hit the market. Always talk to myself or another local agent to determine which projects are most appealing to buyers in your area.

When preparing to sell your home, you want to strike the right balance of upgrades. Making repairs and executing renovations will attract buyer interest, but you don’t want to dump so much cash into remodeling that you won’t be able to recoup those expenses when your home sells.

So, how do you know where to focus your efforts? Your agent is a vital resource in understanding your specific situation—I typically offer guidance to my clients on remodeling efforts that will help sell their home for the best price. Here are a few projects sellers will want to keep off their to-do lists for the best return on investment…

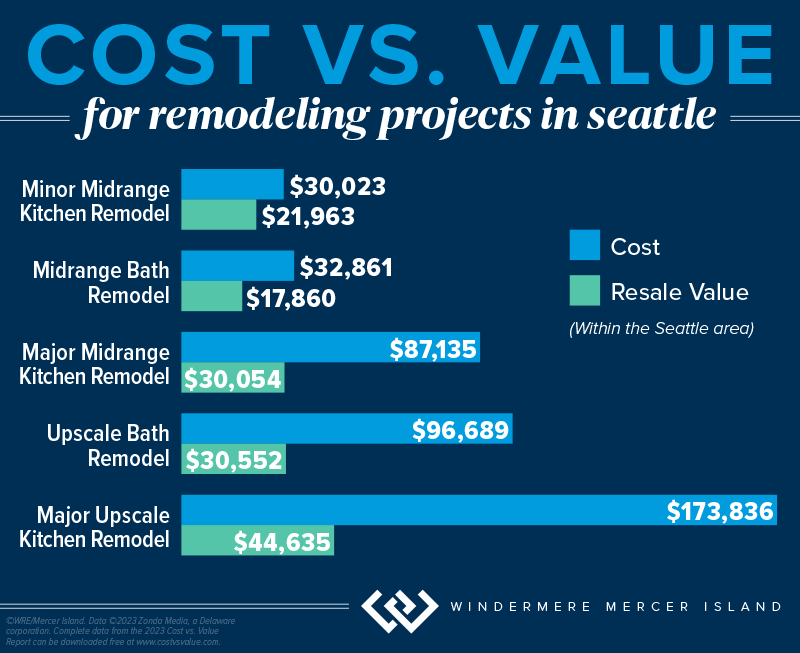

Major, Pricey Upgrades with Long Timelines

For any remodeling project, an analysis of your home’s value will be key to helping you determine its risk/reward potential (reach out if you’d like one for your home). This dynamic is especially important for big remodels and home upgrades, due to their higher costs. The latest Remodeling Cost vs. Value Report (www.costvsvalue.com)1 data for the Seattle area shows a generally negative return on investment for major, upscale remodeling projects—they only recouped about 25%-30% of their cost…

These projects come with hefty price tags and longer timelines than minor repairs and upgrades, which can complicate factors as you prepare to sell, especially if you have a deadline to get into your new home. They have the potential to temporarily displace you from the property, meaning you and your household may have to find somewhere else to stay until the project is complete.

The Bottom Line: To go through with a major home upgrade before you sell, its schedule must fit with your moving timeline. It should also align with buyer interest in your local market. If the project doesn’t meet these criteria, it should be avoided.

Non-Permitted Projects & Building Code Violations

Before you decide to finish out the basement or make changes to your home’s wiring/structure/mechanical systems, it is important to make sure you obtain the proper city, county and/or state permits + inspections. Non-permitted square footage does not reflect on the county tax record and can lead to low appraisals when the buyer tries to get a loan. Obtaining permits also helps ensure your alterations meet the current building code—otherwise, you may face legal exposure should they create a safety hazard. Furthermore, any non-permitted remodels must be disclosed to the buyer on your Form 17 if you live in Washington State. The buyer’s mortgage lender may also have stipulations saying that the loan may not be used to purchase a home with certain features that aren’t up to code, which could lead to them backing out of the deal.

If you’re selling an older home, you’re not obligated to update every feature that may be out of code to fit modern standards. These projects are often structural and require a significant investment. If the violation in question was built to code according to the regulations at the time, then a grandfather clause typically applies. However, you’ll need to disclose these features to the buyer.

Trendy Makeovers and Upgrades

Lastly, it’s best to avoid remodeling projects that target a specific trend in home design. Trends come and go. Timeless design is a hallmark of marketable homes because it appeals to the widest possible pool of buyers. Keep this in mind when staging your home as well. Creating an environment that’s universally appealing and depersonalized allows buyers to more easily imagine the home as their own.

Wondering which remodeling projects might help your home sell? Reach out any time…I’m never too busy to discuss your options and offer advice based on the current market.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

1©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Adapted from an article that originally appeared on the Windermere Blog, written by: Sandy Dodge.

Tax Benefits Every Homeowner Should Know About

More than 26,000 low-income seniors and disabled people in King County who qualify for a tax exemption haven’t claimed it…are you or your family member one of them?

If you are homeowner, make $58k or less per year, and are either age 61+ or retired due to disability, there is a good chance you qualify. You can even retroactively apply for the exemption for the prior 3 years!

Scroll down for details on this exemption plus 4 other property tax relief programs that King County offers.

In another county? Here is the full list of income thresholds for every county in Washington State, and here is another link to view the programs each county offers.

Senior/Disabled Property Tax Exemption

WHAT IS IT?

A reduction in King County property tax for seniors, people with disabilities, and disabled veterans.

WHO QUALIFIES?

- Seniors age 61+

or

- Those who cannot work due to a disability

or

- Veterans with service-related disabilities

YOU MUST…

- Own your home

- Have occupied it as a primary residence at least 6 months out of the year

INCOME LIMIT

- $58,423 maximum annual household income in the previous year

WAYS TO APPLY

- Click here to apply online

- Call 206-296-3920

- Ask your local senior center if they help with applications

Senior/Disabled Property Tax Deferral

WHAT IS IT?

The ability for seniors & disabled people to defer unpaid property tax/special assessments, including back taxes for as long as you’ve owned the home. Deferred taxes + any accumulated interest then become a lien on the property until it’s repaid.

WHO QUALIFIES?

- Seniors age 60+

or

- Those who cannot work due to a physical disability

YOU MUST…

- Own your home and have lived in it for more than 9 months in a calendar year

- Meet an equity requirement

INCOME LIMIT

- $67,411 maximum annual household disposable income

HOW TO APPLY

- Call 206-263-2338

MORE TAX RELIEF PROGRAMS…

Limited Income Deferral

WHAT IS IT?

The ability to defer the second installment of your property taxes/special assessments (normally due October 31st) if you are a low-income homeowner. The deferred taxes plus interest become a lien on the property until they’re repaid.

YOU MUST…

- Have owned your property for 5 years

- Be living in the home as of January 1st of the application year AND more than 9 months during that year

- Meet an equity retirement

- Have already paid the first half of your taxes (due April 30th)

INCOME LIMIT

- $57,000 maximum annual household income in the previous year

HOW TO APPLY

- Call 206-263-2338

Homeowner Improvement Exemption

WHAT IS IT?

Relief from tax increases caused by major additions or remodels.

YOU MUST…

- Own a detached single family dwelling (including mobile homes)

- File your claim for exemption with the assessor BEFORE construction is complete

HOW TO APPLY

- Call 206-263-2338

Flood & Storm Damage Property Tax Reduction

WHAT IS IT?

Tax relief for property damaged by something beyond the owner’s control. Eligible properties receive a reduction of assessed value resulting in lower property taxes. In addition, taxpayers can receive an exemption to keep taxes lower for the 3 years after they rebuild.

YOU MUST…

- Have your property on the assessment roll as of January 1st in the year it was damaged

- Have property that was destroyed, OR was in a declared disaster area and reduced in value by more than 20% as a result of the disaster

HOW TO APPLY

- Complete a Destroyed Property Claim Form and file it with King County Dept of Assessments within 3 years of the damaging event

- Call 206-263-2332 with questions

For more information on any of these programs, visit the King County Assessor’s tax relief page. You can also find info for other counties on the WA Dept of Revenue website.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate/Mercer Island.

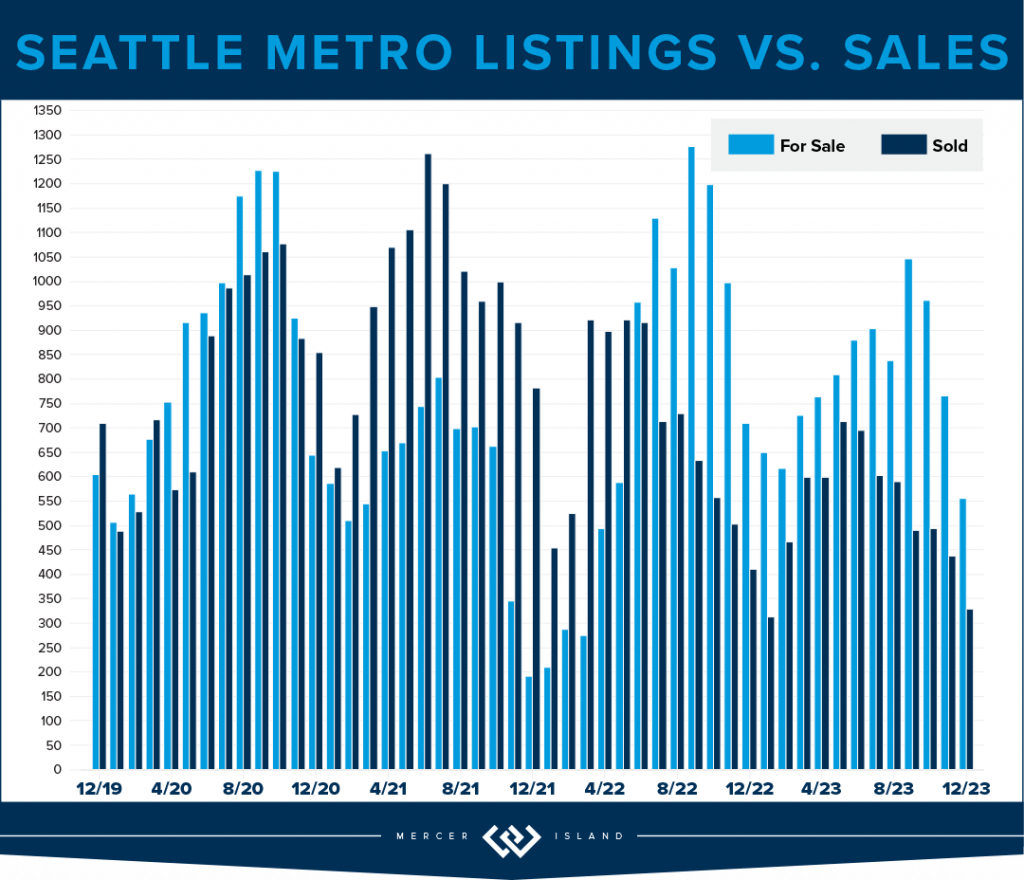

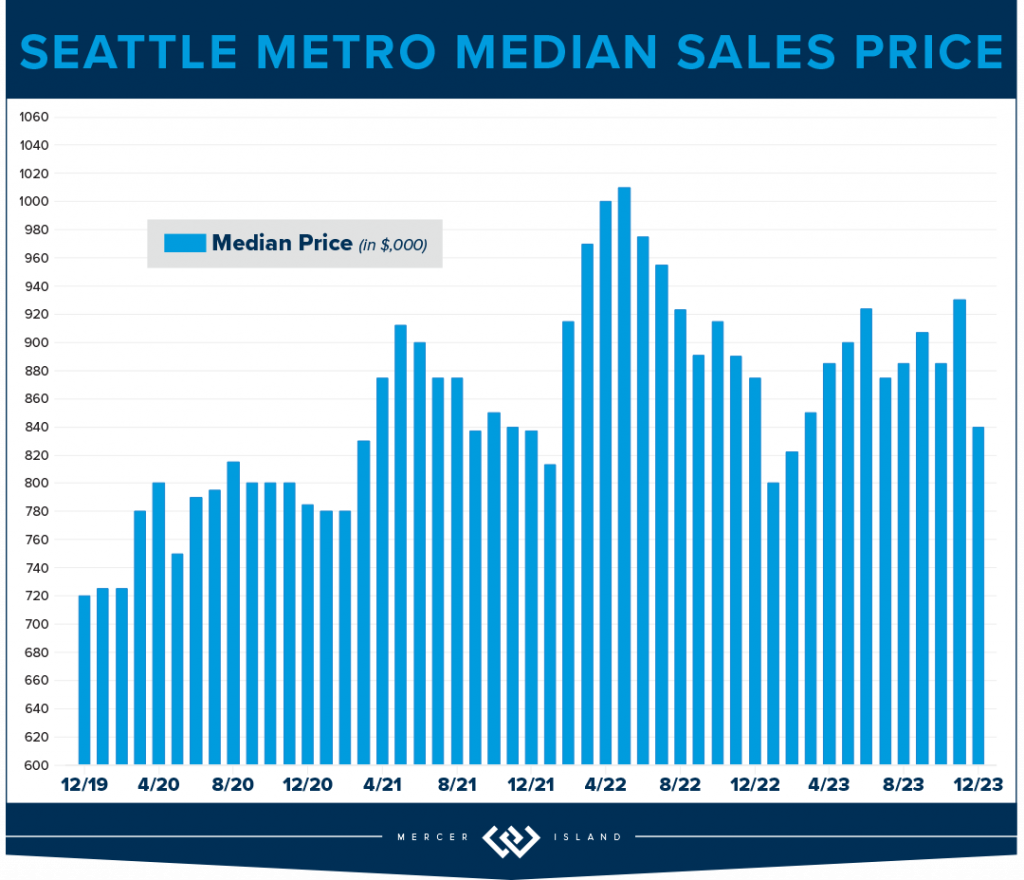

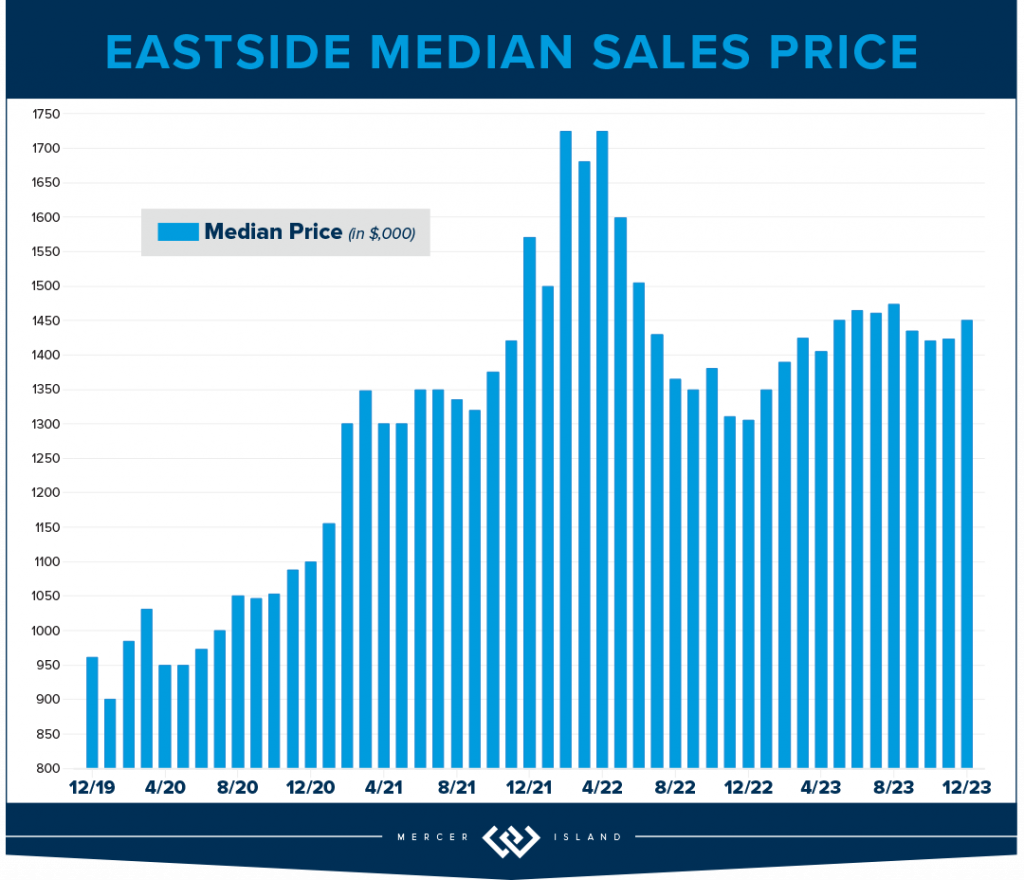

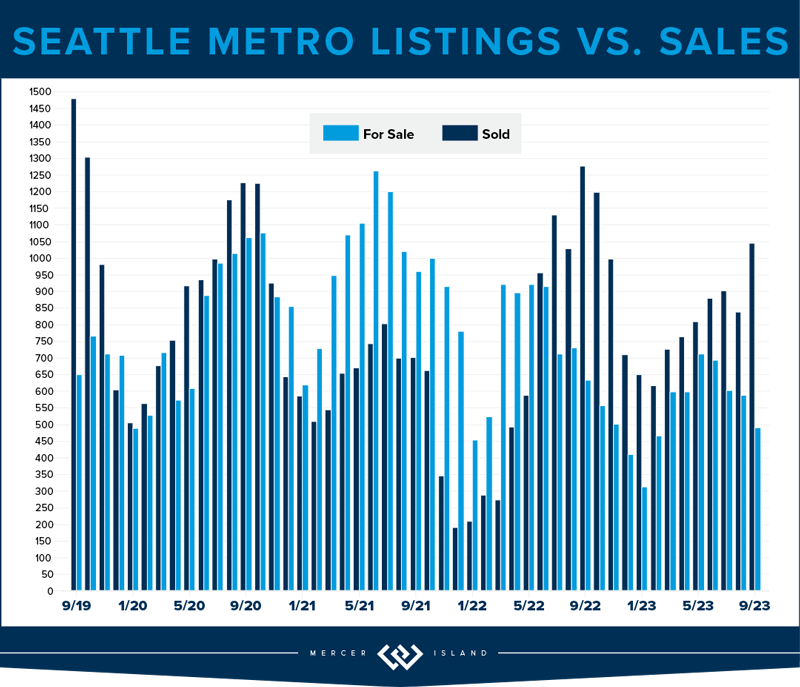

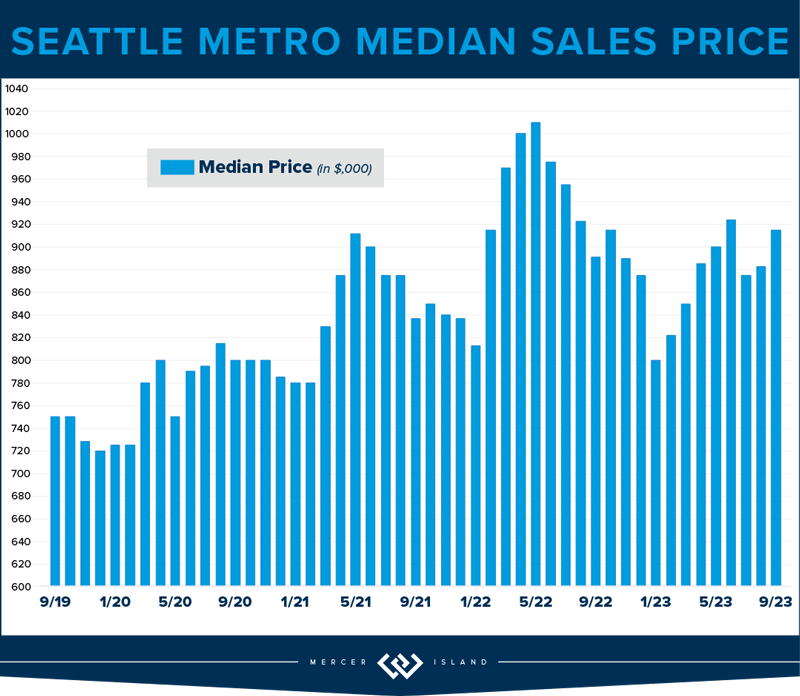

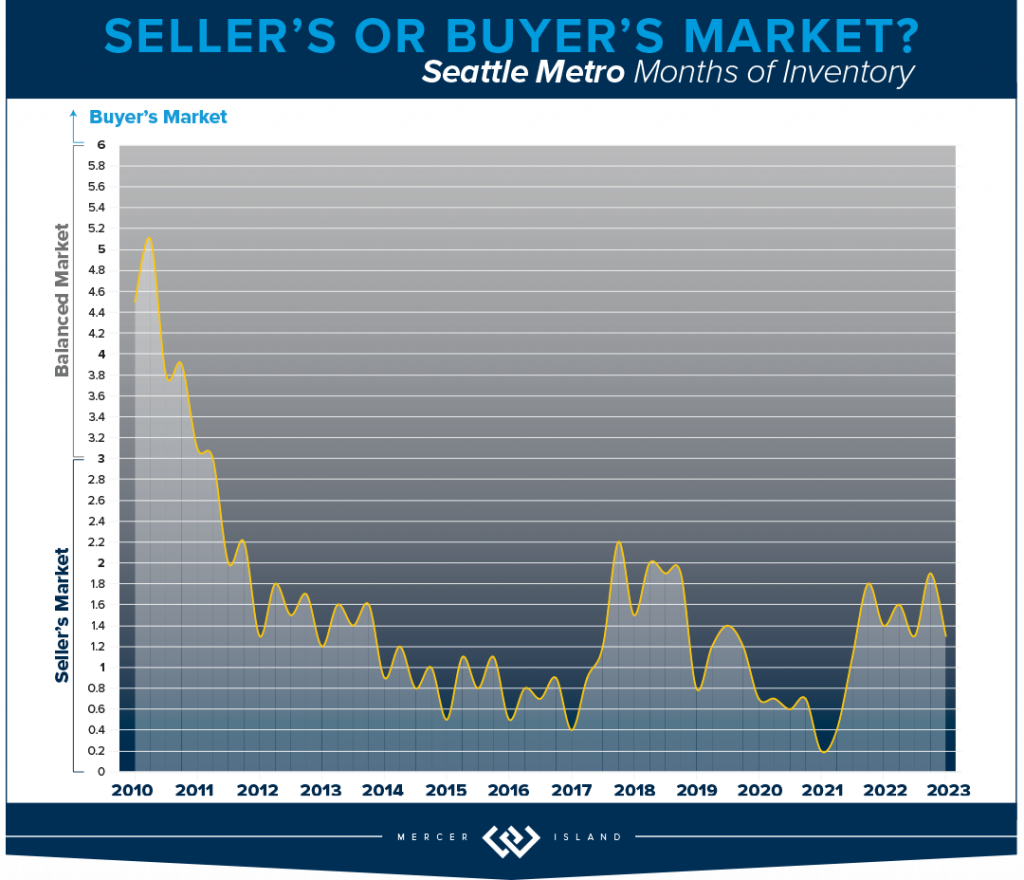

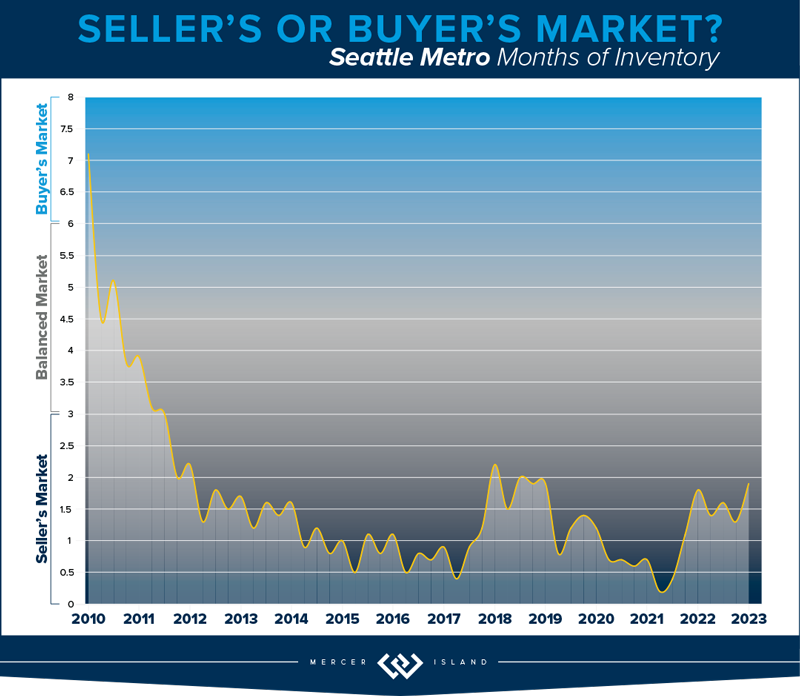

How’s the Market? An Annual Review of Seattle Area Real Estate

Median home sales prices across the region saw a year-over-year dip compared to 2022, with prices settling just above their 2021 levels. That being said, most homes still sold within the first 10 days on the market and either at or above the listing price. Today’s higher rates, in concert with constricted inventory, have slowed the total number of sales. Should rates ease like experts are predicting, however, we will see more people enter the market and hopefully more listings will follow. (Read more about that in our full 2024 forecast).

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

Would you like the good news or the bad news? Bad: Overall home prices slid in the city by 7%. Good: 57% of all homes sold in the first 10 days and for 104% of list price. While we may have backed off of our head spinning pandemic list/sale percentages, we’re still going strong. To us what this means is: if you’re considering selling there is probably a buyer ready and waiting to make you an offer. It just won’t be quite as lucrative as it might have been in 2022. It could be a lot worse given the high cost of money in 2023. Homeowners certainly came out ahead and Seattleites have our chronically low inventory and stable job market to thank for this!

We finished the year with sales down 23%, a figure made a lot less scary by the fact that listings were also down city wide by 24%. North Seattle east of I-5 saw the most stable prices, only losing 2% at a median price of $976,000. Queen Anne/Magnolia lost 10%, closing out the year at $1,263,000. It’s also interesting to note that 65% of homes sold for list price or better. This means we have mostly well counseled homeowners with reasonable expectations of what the market will bear.

If you’re in the market for a new home in 2024, Q1 is a great time! Inventory hasn’t been this low since 2012. If the cost of money goes down—as many experts are predicting—and more people decide to purchase, it could get very competitive very quickly! Beat the rush!

Click here for the full report and neighborhood-by-neighborhood statistics!

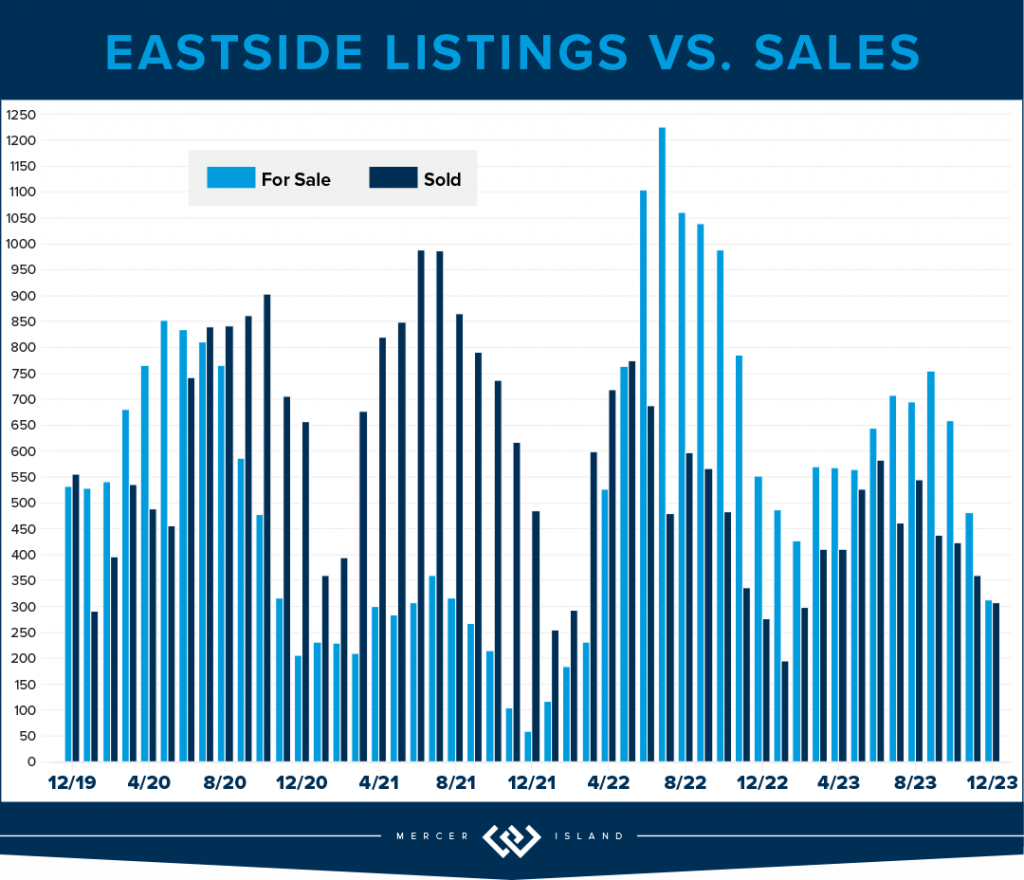

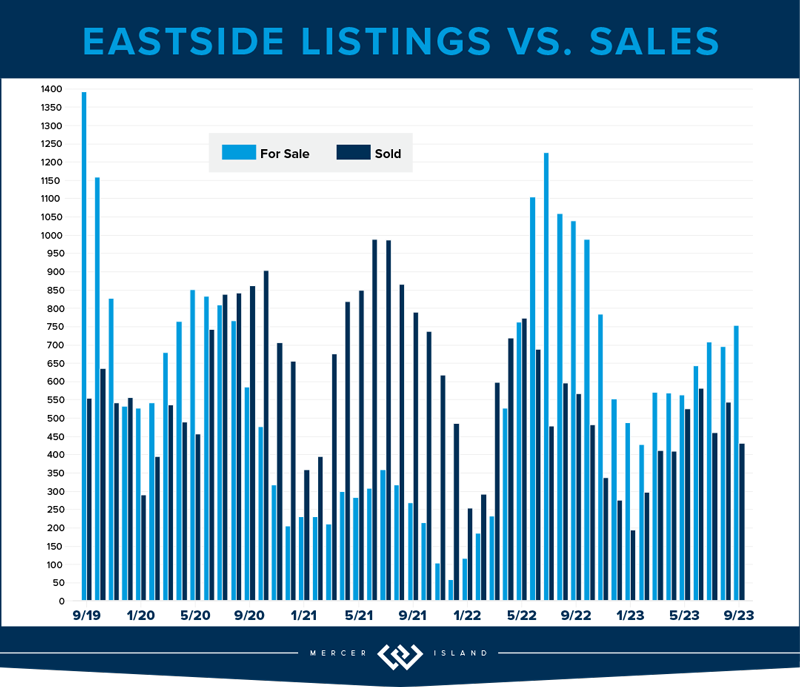

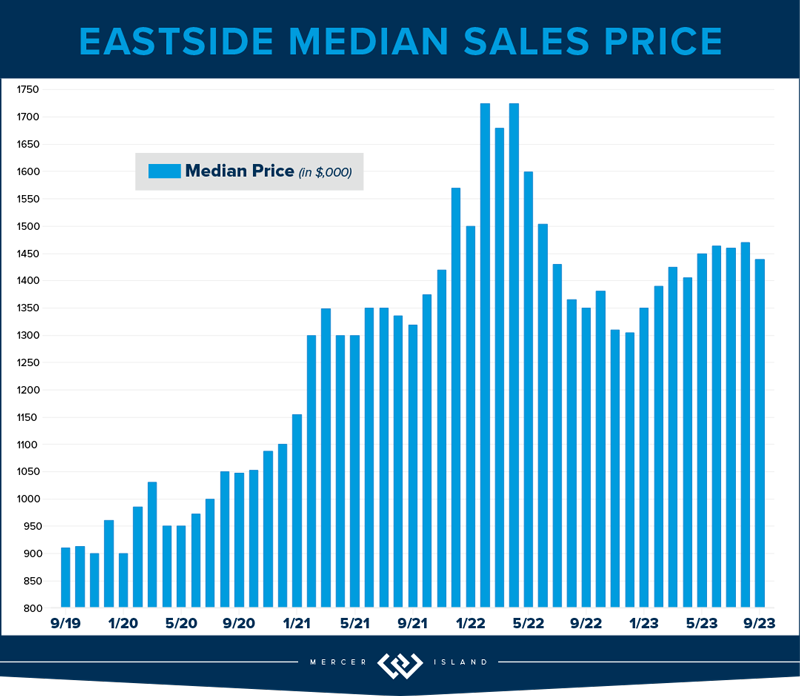

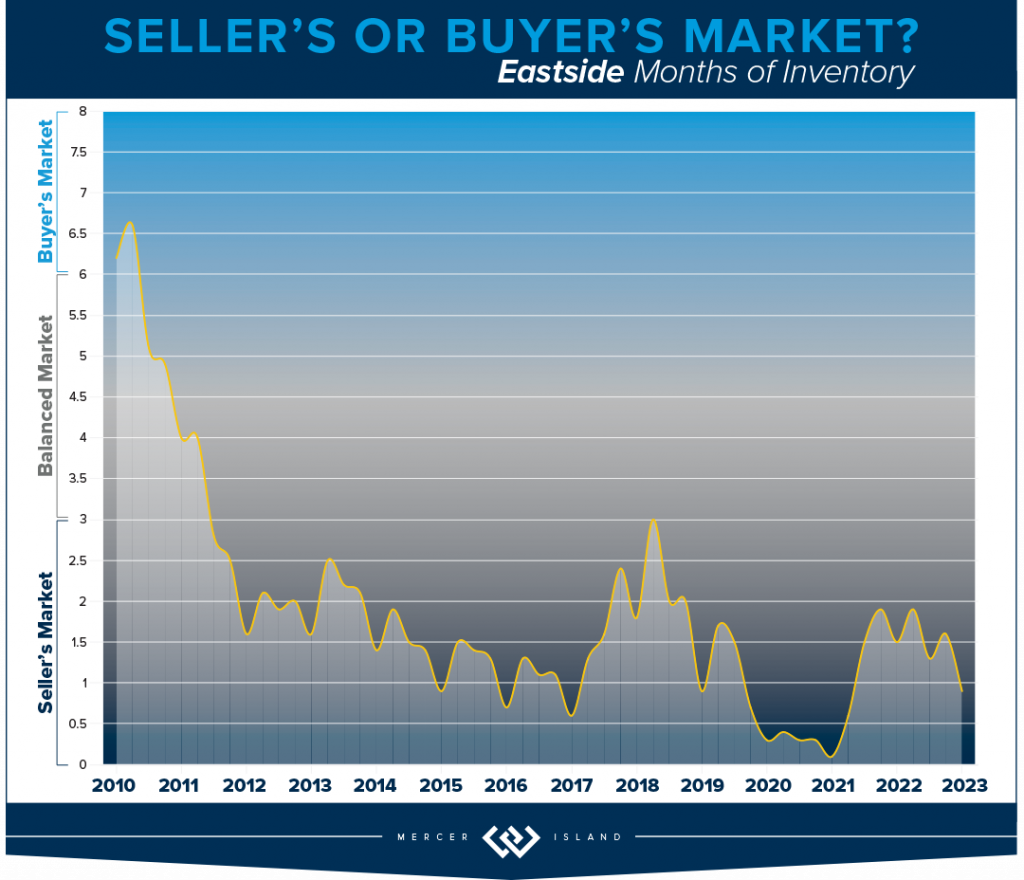

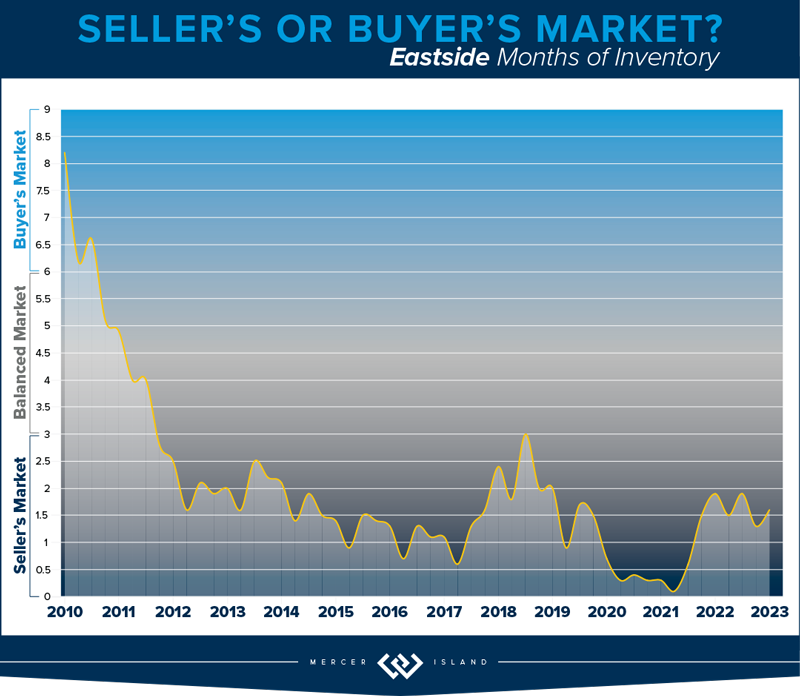

EASTSIDE

The Eastside median sales price was down by 4% as we closed out 2023. This is in large part due to the interest rates. It certainly isn’t supply and demand: Total listings were down 29% while sales only dipped 18% YOY. That’s staggering. Buyers and Sellers did not seem to be aligned in their estimation of the market: only 55% of homes sold for at or above list price while 45% needed a reduction or negotiation prior to accepting an offer. While this sounds balanced, it’s out of the norm compared to our historic data.

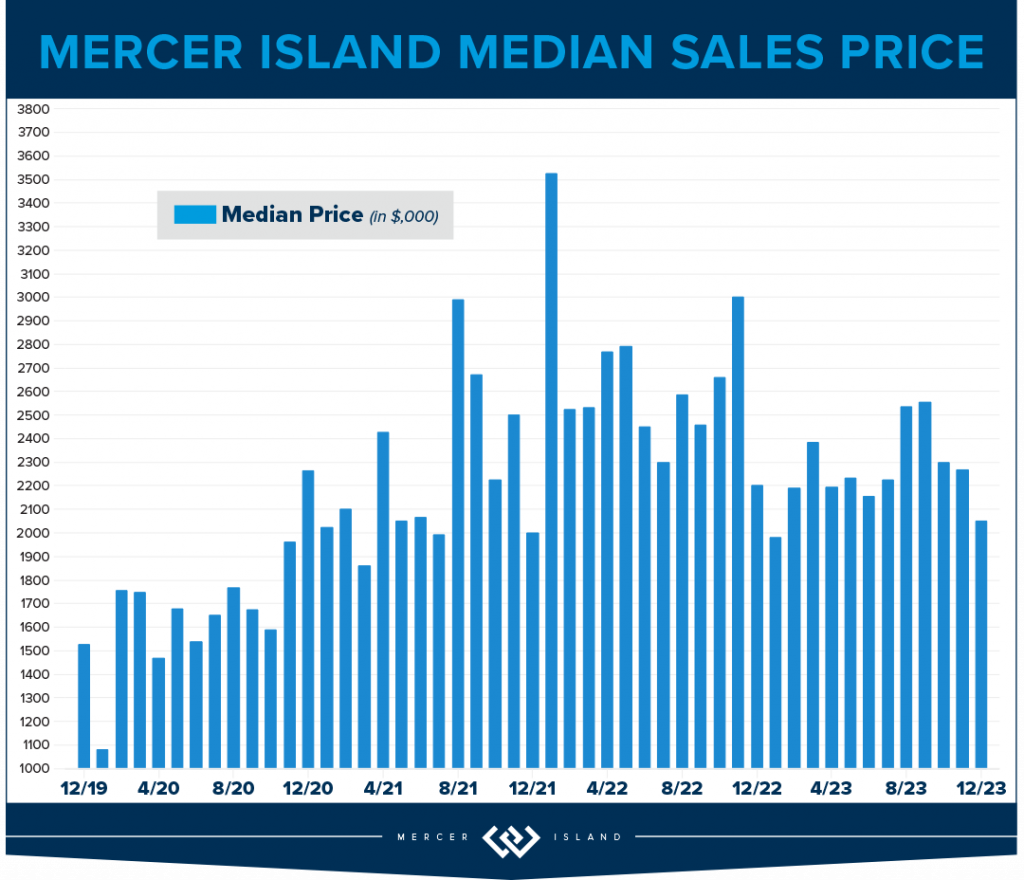

Sammamish was the strongest overall area with a whopping 1217 sales (25% of the total 4954) and the lowest median price dip of 3%; $1,400,000 in 2023 v. $1,450,000 in 2022. Mercer Island was the hardest hit with a 12% drop in median price to $2,239,000—the lowest since 2020. Corrections are healthy for the long-term health of a real estate market. We’re not sure how long this one will last; all signs are pointing to continued low inventory. It seems to be a game of chicken with the interest rates that could lead to massive pent-up demand.

If you’re in the market for a new home in 2024, Q1 is a great time! Inventory is at its absolute 15 year low (6,140 listings compared to a high of 10,880 in 2010) which means we are poised for a market flip. If the cost of money goes down—as many experts are predicting—and more people decide to purchase, it could get very competitive very quickly! Beat the rush!

Click here for the full report and neighborhood-by-neighborhood statistics!

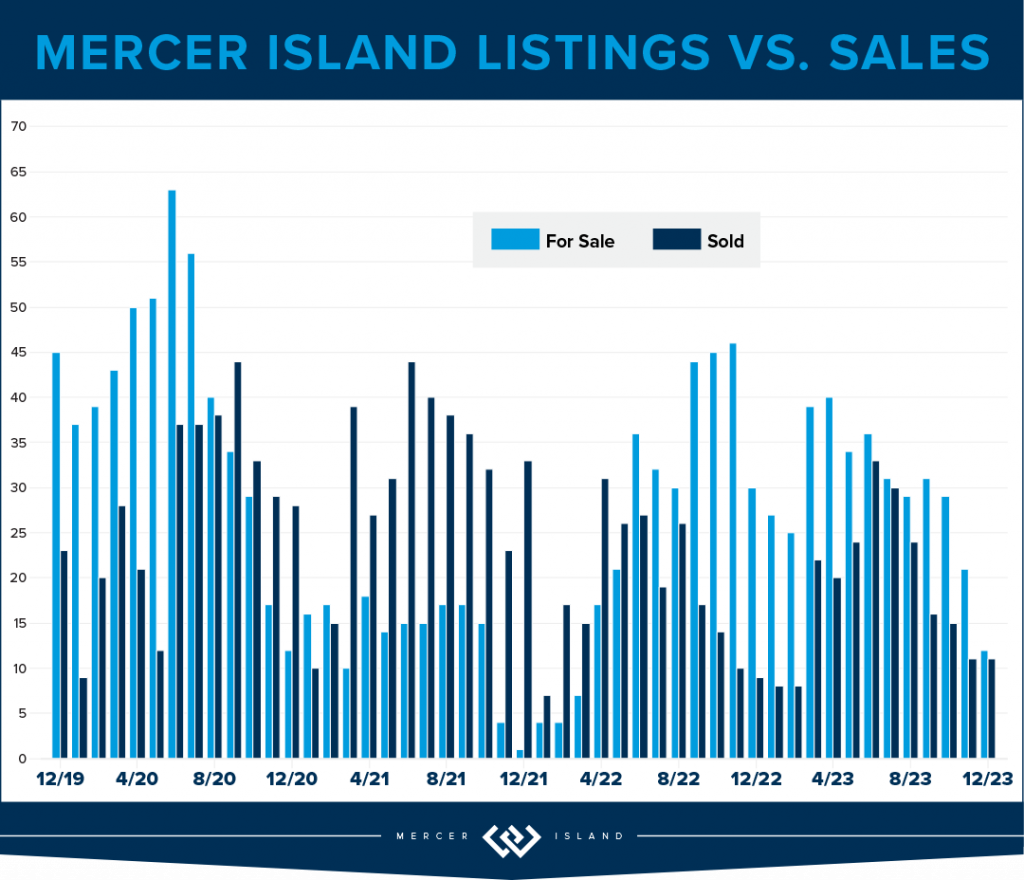

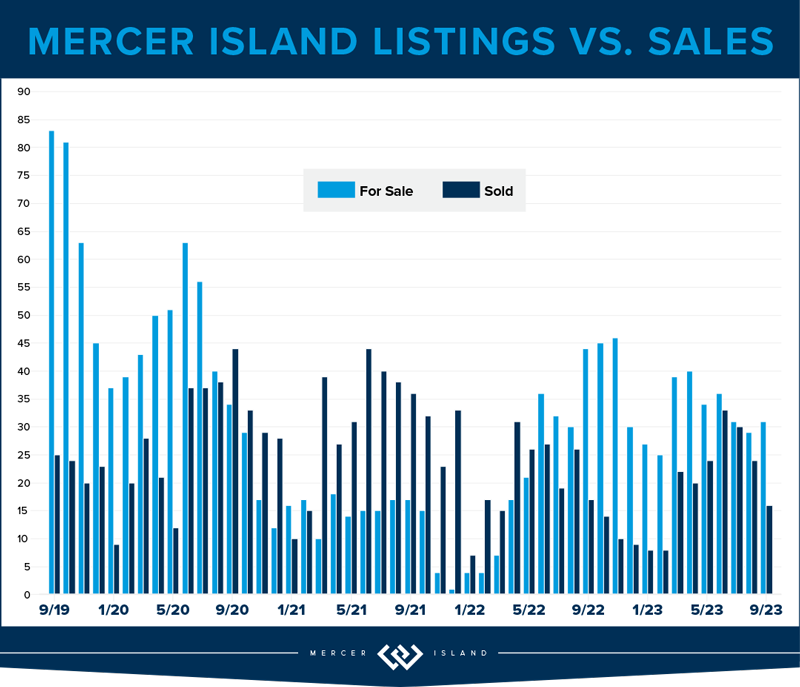

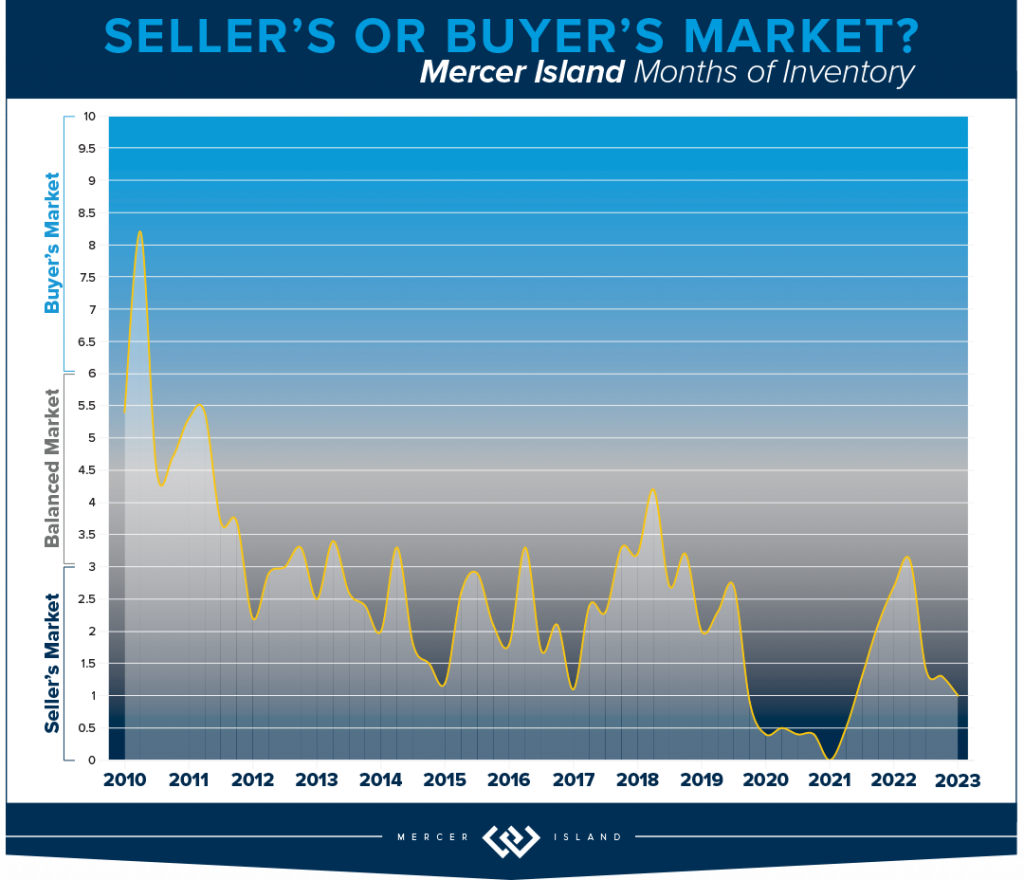

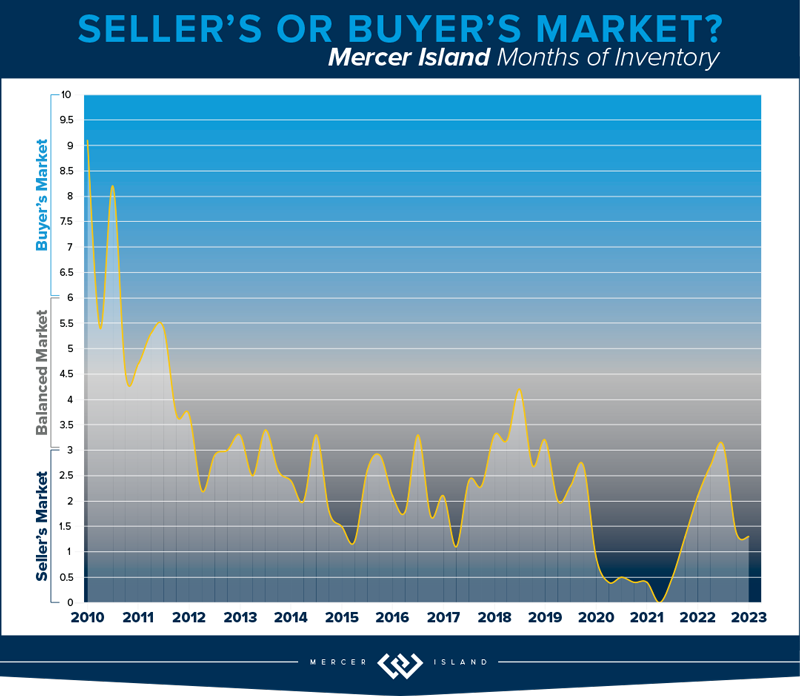

MERCER ISLAND

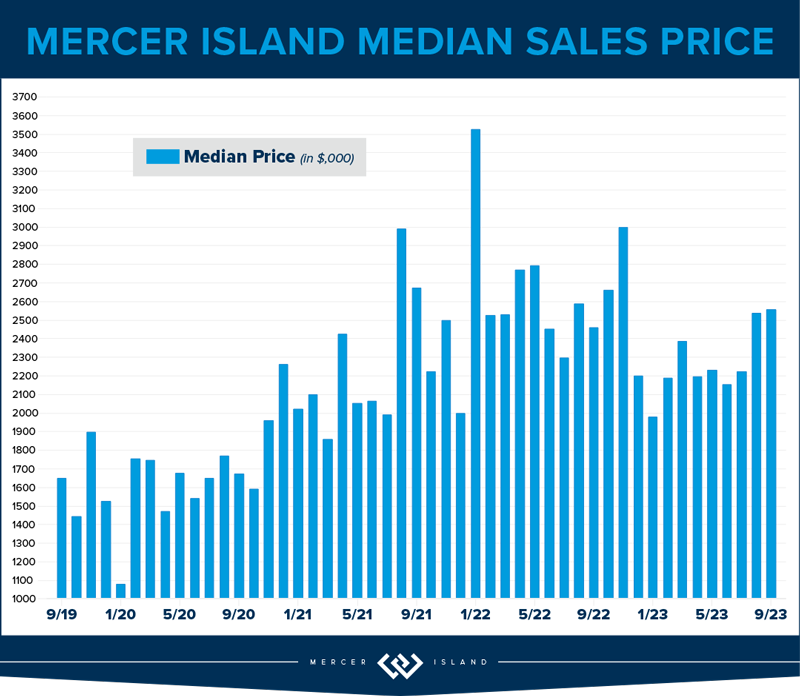

The Island saw just 289 new listings last year, only 60% of the peak 488 in 2013. There are some numbers that show we had very realistic homeowners in 2023: a 78% absorption of listings, (222 sales, up from 218 in 2022) and 98% list/sale price. When buyer and seller expectations meet, magic happens. The median price in 2023 was $2,239,000 back to around the same level as 2021—if you remember, this was a 30% increase from $1,700,000 in 2020.

Condos on the Island are off 8% to $620,000 from the 2022 high of $674,000, this is a strong showing. For the previous 4 years (2018-21) median prices were in the $500’s. There were only 33 sales Island-wide, the lowest number of total sales in 15 years. Listings were down as well: the lowest level since 2012. The metrics show that the market was strong, even with the dip in median sales price: 19 days on market, 99% list/sale price ratio, on average only 4 listings were active at one time. These are all signs of a constricted inventory/sellers’ market, which is what will eventually drive prices higher.

All in all, MI is holding strong to the price gains made during the pandemic. We are bullish on our market in 2024 as interest rates are easing. Time will tell.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Whew! What a year! The major condo headline for both Eastside and Seattle condos: Prices hold steady while demand dips 25%! While this is sensationalized, it’s true. Likely due to the fact that inventory was also down by 20%, which means that supply and demand remained aligned and shielded homeowners from what could have been a massive hit to their bottom lines.

On the Eastside, when the dust settled, prices are down by 1%. The largest drop in median price was East Bellevue losing 11% while Kirkland soared above all other neighborhoods with double digit gains (up 19%). Other areas of note: West Bellevue topped the charts with a median sale price of $880,000! This is higher than the $876,000 residential median sale price in the city of Seattle.

Speaking of Seattle, the condo market in the city reminds us of The Little Engine That Could. Chugging merrily along despite having the odds stacked against it: I think I can! Overall, the city posted a 5% gain year over year with record high median sales price of $546,000. Downtown saw the highest overall unit volume at 439 total sales, while Greenlake/Ballard boasted the highest overall gain in median price at 15% appreciation. All good news, finally.

Check out area-by-area details the full condo report.

WATERFRONT

While Seattle and the Eastside both posted fewer waterfront sales in 2023 than in 2022, Lake Sammamish saw a big 40% year-over-year jump in sales. Mercer Island’s sales increased by a more modest 10%.

The highest waterfront sale of 2023 was $20 million for a breathtaking Evergreen Point estate on 115 feet of prime low-bank shoreline. Listed by Windermere and truly unique with a custom home designed by Hal Levitt, it sold its first day on the market (and well above the $18.5m asking price!).

The most modest waterfront sale was a 1,749 sq. ft. Lake Sammamish home sold by the owner for $1.62 million. It featured 25 feet of lakefront and big lake/mountain views.

Click here for the full waterfront report with top sales for the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish. The data is interesting and insightful (but cannot replace an in-depth waterfront analysis with your trusted professional).

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Team RAREnorthwest and Baylee Reinert with Clarity NW Photography. Eastside cover photo courtesy of Donna Cowles and Kelly Morrissey with Clarity NW Photography. Mercer Island cover photo courtesy of the Oordt Ceteznik Realty Group and Clarity NW Photography. Condo cover photo courtesy of Fred Fox and Brandon Larson with Clarity NW Photography. Waterfront cover photo courtesy of Anni Zilz and Andrew Webb with Clarity NW Photography.

Top 10 Predictions for 2024 Real Estate

Will 2024 be a good year for real estate? This question comes up a LOT, especially from those who are considering buying or selling a home in the near future. Housing economist Matthew Gardner weighed in with his top 10 predictions for what the real estate market will look like in the coming year. Here is what he had to say…

1. Still no housing bubble

This was number one on my list last year and, so far, my forecast was spot on. The reason why I’m calling it out again is because the market performed better in 2023 than I expected. Continued price growth, combined with significantly higher mortgage rates, might suggest to some that the market will implode in 2024, but I find this implausible.

2. Mortgage rates will drop, but not quickly

The U.S. economy has been remarkably resilient, which has led the Federal Reserve to indicate that they will keep mortgage rates higher for longer to tame inflation. But data shows inflation and the broader economy are starting to slow, which should allow mortgage rates to ease in 2024. That said, I think rates will only fall to around 6% by the end of the year.

3. Listing activity will rise modestly

Although I expect a modest increase in listing activity in 2024, many homeowners will be hesitant to sell and lose their current mortgage rate. The latest data shows 80% of mortgaged homeowners in the U.S. have rates at or below 5%. Although they may not be inclined to sell right now, when rates fall to within 1.5% of their current rate, some will be motivated to move.

4.Home prices will rise, but not much

While many forecasters said home prices would fall in 2023, that was not the case, as the lack of inventory propped up home values. Given that it’s unlikely that there will be a significant increase in the number of homes for sale, I don’t expect prices to drop in 2024. However, growth will be a very modest 1%, which is the lowest pace seen for many years, but growth all the same.

5. Home values in markets that crashed will recover

During the pandemic there were a number of more affordable markets across the country that experienced significant price increases, followed by price declines post-pandemic. I expected home prices in those areas to take longer to recover than the rest of the nation, but I’m surprised by how quickly they have started to grow, with most markets having either matched their historic highs or getting close to it – even in the face of very high borrowing costs. In 2024, I expect prices to match or exceed their 2022 highs in the vast majority of metro areas across the country.

6. New construction will gain market share

Although new construction remains tepid, builders are benefiting from the lack of supply in the resale market and are taking a greater share of listings. While this might sound like a positive for builders, it’s coming at a cost through lower list prices and increased incentives such as mortgage rate buy downs. Although material costs have softened, it will remain very hard for builders to deliver enough housing to meet the demand.

7. Housing affordability will get worse

With home prices continuing to rise and the pace of borrowing costs far exceeding income growth, affordability will likely erode further in 2024. For affordability to improve, it would require either a significant drop in home values, a significant drop in mortgage rates, a significant increase in household incomes, or some combination of the three. But I’m afraid this is very unlikely. First-time home buyers will be the hardest hit by this continued lack of affordable housing.

8. Government needs to continue taking housing seriously

The government has started to take housing and affordability more seriously, with several states already having adopted new land use policies aimed at releasing developable land. In 2024, I hope cities and counties will continue to ease their restrictive land use policies. I also hope they’ll continue to streamline the permitting process and reduce the fees that are charged to builders, as these costs are passed directly onto the home buyer, which further impacts affordability.

9. Foreclosure activity won’t impact the market

Many expected that the end of forbearance would bring a veritable tsunami of homes to market, but that didn’t happen. At its peak, almost 1-in-10 homes in America were in the program, but that has fallen to below 1%. That said, foreclosure starts have picked up, but still remain well below pre-pandemic levels. Look for delinquency levels to continue rising in 2024, but they will only be returning to the long-term average and are not a cause for concern.

10. Sales will rise but remain the lowest in 15 years

2023 will likely be remembered as the year when home sales were the lowest since the housing bubble burst in 2008. I expect the number of homes for sale to improve modestly in 2024 which, combined with mortgage rates trending lower, should result in about 4.4 million home sales. Ultimately though, demand exceeding supply will mean that sellers will still have the upper hand.

About Matthew Gardner

Matthew Gardner analyzes and interprets economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

Matthew also sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Adapted from an article that originally appeared on the Windermere blog December 4th, 2023. Written by: Matthew Gardner.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

When is the Best Time to Buy or Sell a Home?

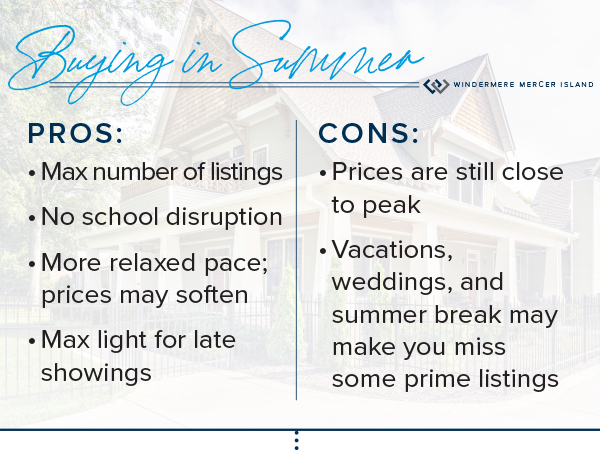

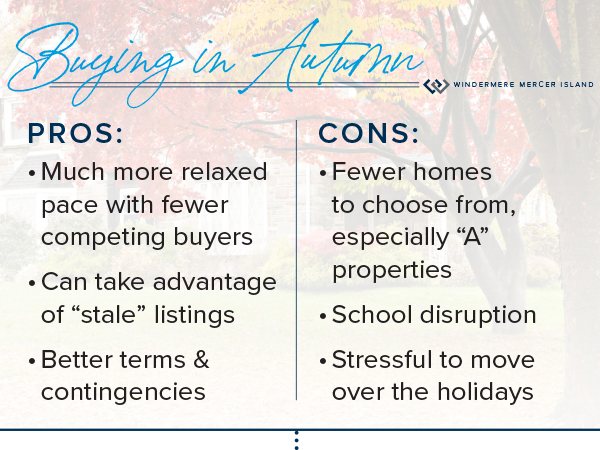

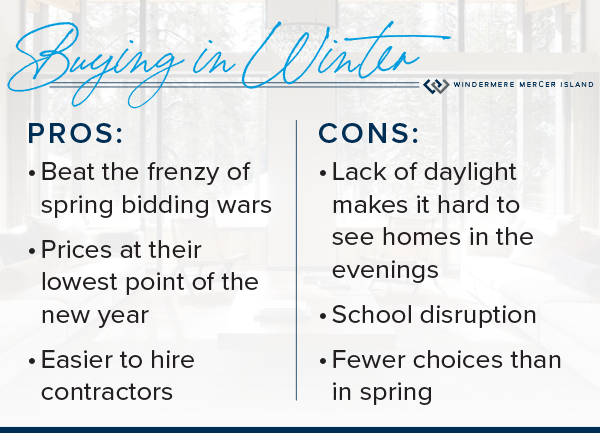

Market peaks, holidays, school, oh my! Once you’ve decided that you want to sell or buy a home, the when can be tricky to tackle. Many factors contribute to optimal timing. Scroll down for the pros and cons of selling or buying in each season.

While each season has its perks and challenges, your personal circumstances will be the most important consideration. Relocation, marriage, divorce, or other life changes may mean that it makes the most sense for you to move now regardless of market factors. If you have kids in school, it may be best to wait until after the school year to make your move.

If your timing is flexible, on the other hand, you’ll also want to consider things like the condition of your property—homes that need work or have challenges with location/layout may require a hot market (or serious lack of competing inventory) in order to sell. You’ll also want to analyze the micro-market in your neighborhood, including how many other listings are currently for sale. Check out our article on timing the market for some great tips on that.

Seasonal cycles are definitely worth considering. For sellers looking to get the maximum number of eyes on your home, it’s important to avoid listing during holiday weeks or inclement weather events like snow. Buyers might find it more difficult to purchase a home at the peak of the market when homes are selling like hotcakes. Below is a chart showing typical market activity based on a five-year average of pending sales.

When my clients ask for my advice on when to sell or buy, I typically analyze all of these factors along with seasonal pricing trends. Below are some of the pros and cons I tend to see for buyers and sellers in each season…

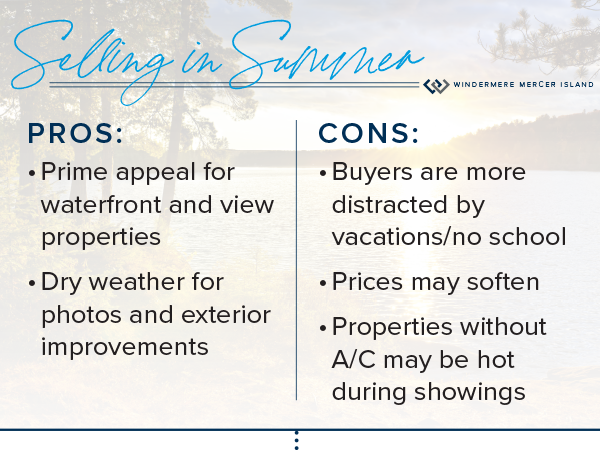

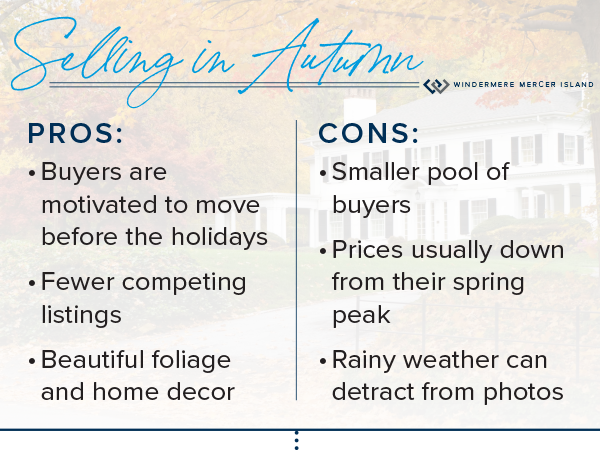

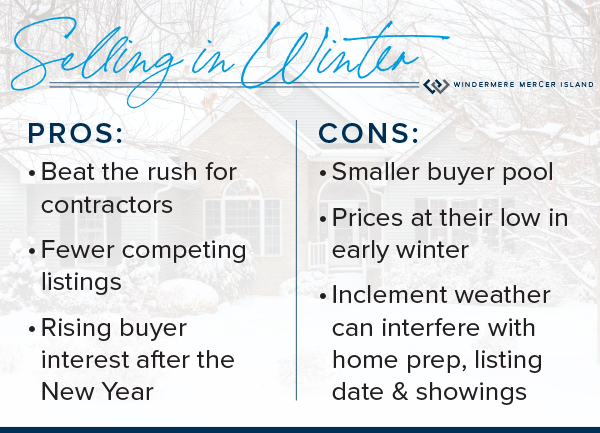

SELLING

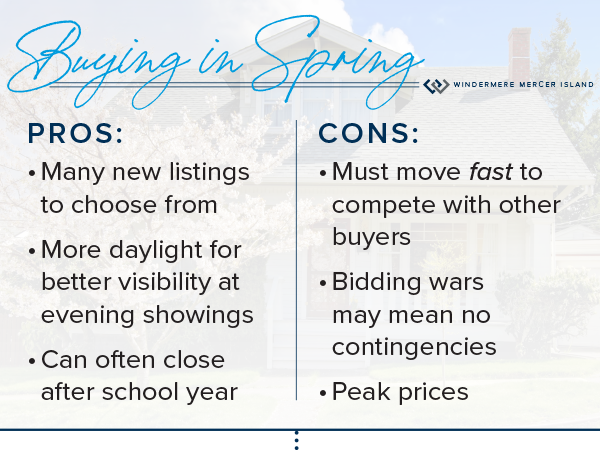

BUYING

Pssst…I know decisions like this can feel overwhelming. Reach out any time for expert advice. I’m always happy to discuss your options and help you choose the best timing for your unique property, circumstances, and micro-market…

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate/Mercer Island.

How’s the Market? Q3 2023 Review of Seattle Area Real Estate

While median sales prices varied quite a bit from area to area, they stayed relatively stable with most communities posting either modest gains or slight declines compared to this time last year. Low inventory is keeping us in what you might call a “flat” seller’s market…supply is low but prices aren’t appreciating as fast as we would normally see. That being said, if rates float down—and experts believe they will—we could see another frenzy of bidding wars as buyers compete for the few homes on the market. If you’re considering purchasing a home (even if you need to sell yours first), our advice is to get out there and start shopping while you can pick and choose at relatively reasonable prices…

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

The Seattle residential market showed resilience in Q3 of 2023. While the $894,000 median sales price was down 3% from last year, 60% of sellers fetched sales at or above their list price and 58% sold within the first 10 days. The city saw 2,321 new listings, a 23% reduction from the previous year. This is healthy, for now, with decreased demand due to rising interest rates. When rate pricing eases—and it will according to experts—the lower inventory will be sure to send prices through the roof. NOW IS THE TIME!

Diving deeper into communities, Queen Anne, with its blend of historic charm and modernity, saw a 1% rise in median sales prices to $1,349,000. Kenmore and Lake Forest Park have also held their own—60% of homes sold within the first ten days and both median sales prices and cost-per-square-foot went up 2% over last year. North Seattle remains a strong contender in the market, with 68% of homes selling at or above the list price. West Seattle, with its coastal vibe, saw a remarkable 72% of homes sell at or above the listing price.

The data underscores Seattle’s diverse and dynamic housing landscape, where different communities cater to varied tastes, yet all show promise and potential. Overall, Seattle’s housing market is marching on, optimistically steady, backed by strong analytical data and historically low unemployment.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

The Eastside showed steady growth in Q3. With a notable 5% year-over-year rise in home values, the median sales price landed at a respectable $1,460,000. Interestingly, cost per square foot ($625) showed virtually no YOY change. Sellers saw a close alignment with their expectations, as the average list price to sale price for all properties stood at 99%. Furthermore, 58% of homes sold at or above their listing price, a testament to the region’s enduring demand.

Diving deeper, most communities remained fairly stable with modest year-over-year increases. Redmond, Mercer Island and Newcastle/North Renton saw slight declines. The star of the Eastside was West Bellevue, posting 23% more sales than Q3 of last year, a median sales price hike of 14%, and the highest cost-per-square-foot in the region (even after a 14% drop from last year). While overall sales were down about 13% across the region, this was counterbalanced by a 20% drop in new listings keeping the Eastside in a flat seller’s market for the foreseeable future.

Our conclusion? The Eastside’s market remains robust and versatile. Buyers and sellers both need to be savvy, understanding both their micro-markets and the broader trends. For sellers, strategic pricing and presentation remain king! Our advice to buyers: don’t sleep on this market, it will turn fast when interest rates float downward and inventory will not be able to keep up with demand.

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

While Mercer Island’s Q3 median sales price of $2,368,000 was still down slightly compared to Q3 of last year, prices have been trending upward since the beginning of the year. Furthermore, the average price-per-square-foot in Q3 was actually up 6% over last year. More than half of homes sold at or above their list prices (53%) and in 10 days or less (57%)—this is right on par with what we saw in Q3 of 2022. Buyers found room to negotiate on the remaining listings and were able to add contingencies for things like inspections and financing.

We saw a boost in sales compared to last year’s initial interest rate shock, despite a lower number of new listings. This has kept the Island in a flat seller’s market much like we saw in 2018. That being said, Mercer Island homes are taking longer to sell than we saw last year—the average total number of days properties spent on the market before receiving an offer went from 18 days in Q3 2022 to 30 days by Q3 2023. Buyers, perhaps more hesitant due to higher interest rates, are being careful to pick and choose before leaping into a contract.

Overall, the Mercer Island real estate market has remained fairly steady with some signs of growth. While median prices are still down from their spike during the post-COVID frenzy, we should start seeing year-over-year gains if this year’s upward trend continues. For prospective buyers, the landscape offers an opportunity to negotiate favorable deals on those properties that don’t sell right away. For sellers, astute pricing and marketing strategies will continue to win the day.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

The PNW condo market showed steady growth in Q3 of 2023, with year-over-year median sales prices up by 6% in both Seattle and The Eastside. Overall activity was subdued, however, with a drop in the number of new condo listings corresponding with fewer sales.

When dissecting Seattle’s condo statistics, Shoreline, Lake Forest Park and Kenmore saw the biggest price gains with a whopping 39% rise in median sales price compared to last year. Ballard and Green Lake also saw big gains with median sales price up 25%. Conversely, Shoreline experienced a stark 59% drop in sales and 40% drop in median sales prices, indicating possible shifts in buyer preferences toward the more convenient city center. While Downtown condo sales prices were also down slightly, their shimmering skylines still fetched a premium at $825 per square foot.

The Eastside condo market varied from area to area. Kirkland’s condo sales surged by 18%, with an impressive 43% increase in median sale price. Redmond also shone brightly with a 45% spike in median sale prices. Mercer Island stood out, with its 43% increase in the number of sales and 31% rise in median sale price showcasing its luxury market segment. Conversely, West Bellevue, East Bellevue, and East Lake Sammamish all posted lower year-over-year median sales prices—down -20%, -%12% and -7% respectively.

The juxtaposition of these two markets, and really the neighborhood specific swings within them, highlights the unique characteristics and demands of each, underscoring the need for prospective buyers and sellers to strategize based on specific community data. All the more reason to consult a condo pro!

Check out area-by-area details the full condo report.

WATERFRONT

Seattle once again commanded the highest number of private waterfront sales with 9 total—4 of these sold in 4 days or less, including 2 hot Beach Drive listings in West Seattle that sold above their asking prices. Lake Sammamish was close behind with 8 sales including one that sold immediately (and marked the most affordable waterfront sale at $1.62 million). Mercer Island boasted the highest waterfront sale of the quarter, a stunning North End estate on 120 feet of waterfront that went for $24.4 million. The Eastside held its own with 6 sales and the second highest sale of the quarter—$12 million—for a half-acre Yarrow Point estate on 105 feet of prime west-facing waterfront.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Codi Nelson and HD Estates. Eastside cover photo courtesy of Team RAREnorthwest and Elevato Photography. Condo cover photo courtesy of Jessica Livingston and im3rd Media. Waterfront cover photo courtesy of Anni Zilz and Clarity Northwest Photography.

To Sell or to Rent? The Perks and Pitfalls of Being a Landlord

Analyzing whether to sell or rent your home is a BIG deal…and it deserves careful consideration. Ultimately, the right choice for you depends on your financial situation, goals, and personal preferences. Here is a quick run-down to help you decide:

Renting Out Your Home Might Make Sense If…

- You don’t need the funds from your current home to purchase another home

- You’re moving temporarily and planning to return to the area

- You think your home’s value will drastically increase within the next few years

- The rental market is especially hot in your area

- You have the time and know-how to screen tenants, manage rent/collections, and make home repairs (or would have enough cash flow to pay for third-party management)

- Rental income is part of your long-term investment strategy

Selling Your Home Might Make Sense If…

- You need to use the equity from your current home to purchase another home

- Rent wouldn’t generate enough cash flow to cover things like vacancies, maintenance, repairs, and landlord insurance in addition to the existing mortgage, taxes, and HOA dues

- You don’t want to take on the risks, time commitment, and challenges of being a landlord

- You’re uncomfortable with the landlord-tenant laws in your area

- A home sale would generate a large profit (and has been your primary residence for at least 2 out of the last 5 years so that you’re eligible for capital gains tax exemptions)

- You’re concerned a future recession might negatively impact your finances

Before reaching a conclusion, it’s a good idea to familiarize yourself with the landlord-tenant-law specific to your state (and in some cases, separate relevant ordinances in the city and/or county that your property lies within). You should also do some market research to get a feel for price/condition of similar homes for rent and for sale in your neighborhood.

It probably makes sense to talk with a property management professional to clearly understand what you can expect to net as a landlord. You can also reach out to me any time for an accurate estimate of your home’s value should you decide to sell.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate / Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link